Every company, big and small, goes through cycles of low profitability, when demand for their product or the cost of doing business negatively changes. With good management, the company adapts and continues to be profitable. But sometimes the forces that affect an entire industry are so large that companies have to make radical changes to their operations in order to survive.

An example is the movement of clothing manufacturers from the U.S. to China. It’s a very labor-intensive industry where the other necessary inputs — sewing machines and textiles — are readily available almost anywhere in the world. China has always had lower labor costs, but it didn’t make sense to produce clothing for the U.S. market there until the cost of shipping their products became so low that the full price of production was lower than what U.S. factories could achieve. The introduction of the shipping container and of giant container ships made the difference.

That force was so large that better business management didn’t matter. Competing in the U.S. against China-made clothing was impossible unless you found a specialty niche.

Every industry doesn’t face such dramatic changes, but they all have vulnerabilities. Identifying those vulnerabilities is the first step to finding ways to manage them. Sometimes there aren’t ways to mitigate such challenges — you can see only so far ahead, after all — but very often companies don’t fully appreciate the existing risks that determine their own profitability.

And it’s not just industry-wide forces that affect companies; local factors are often even more powerful because most businesses only operate in their local market. For instance, if the population of their market is stagnant or shrinking, even the best-managed local grocers will have difficulties, no matter how good or cheap their products are.

Large forces, like a recession, further expose and magnify business risks, but it’s in the ordinary economic environment that companies face constant challenges.

Identifying an industry’s susceptibilities

You could write a book about this, but we’ll just list several types of vulnerabilities that businesses and entire industries should be attuned to.

Demand

Demand is usually outside a company’s control and difficult to predict, which is why most companies don’t worry about it enough, especially if things are going well right now. This is particularly true in the manufacturing sector, where most companies make products for other companies and thus worry more about keeping that business than about their customers’ prospects.

Population flows, changing demographics, and personal finances are crucial elements of demand from consumers, who are the ultimate buyers of all products. A maker of car parts might want to keep track of those elements even if their direct customer is Ford.

In the retail and finance sectors, large companies often know a lot about their customers through various surveys and feedback, but smaller businesses generally don’t.

Costs

Businesses and industries have inputs and outputs. The inputs often include materials, energy, rents, and labor, and assets like machinery, computers, land, and buildings.

Material inputs can be raw products like iron ore and grains (or, if you’re a Waffle House — eggs); components like plastic tubing and cardboard; or finished products like cars and boxes of breakfast cereal.

Labor problems often have more to do with the availability of human capital than with costs. There are a lot of jobs that people just don’t want to do, and increasingly, there are jobs for which not enough people are qualified. One part of this equation is the fact that the U.S. lacks the apprenticeship programs that are common in some countries.

Energy and interest rates are special costs because they affect all businesses and also have political consequences. The hike in oil prices after the invasion of Ukraine in 2022, from $50 a barrel to more then $100, led to higher prices for almost all products and the doubling of mortgage rates. Interest rates also affect businesses directly if they finance inventories and capital equipment, or if they issue debt.

The cost of inputs changes all the time but usually not dramatically — and it’s not possible to predict Covid or an outbreak of bird flu that jacks up the cost of eggs 100%. But businesses CAN identify how important each cost is to the profitability of their business and how MUCH those costs have varied in the past.

Another important thing to know — and why understanding demand is also so important — is whether higher costs can be passed along to customers. If you’re a high-end restaurant, it’s easy to increase menu prices for the higher cost of eggs. If you’re a Waffle House, it’s not.

Finances

In addition to inputs and outputs, the financial structure of a business — often a feature of the industry itself — can be a vulnerability. Manufacturers of products with seasonal sales, like cars, skis, and motor boats, may carry growing inventories themselves or finance their customers’ purchases. Insurance companies often invest in office buildings or other income-producing real estate whose future value is unknown. Small businesses often depend heavily on small business loans that come with restrictions.

Typical balance sheets vary from industry to industry and reveal special risks in the inventories and equipment they have to carry or the amounts and kinds of debt and liquidity they hold.

Then there’s the question of how profitable a business has to be: what owners and shareholders expect. Utilities, for example, can get along with regulated, dependable returns, but the pharmaceutical industry says high profits are necessary to discover future drugs and treatments, and tech companies have to promise giant profits to attract venture capital.

Interest rates

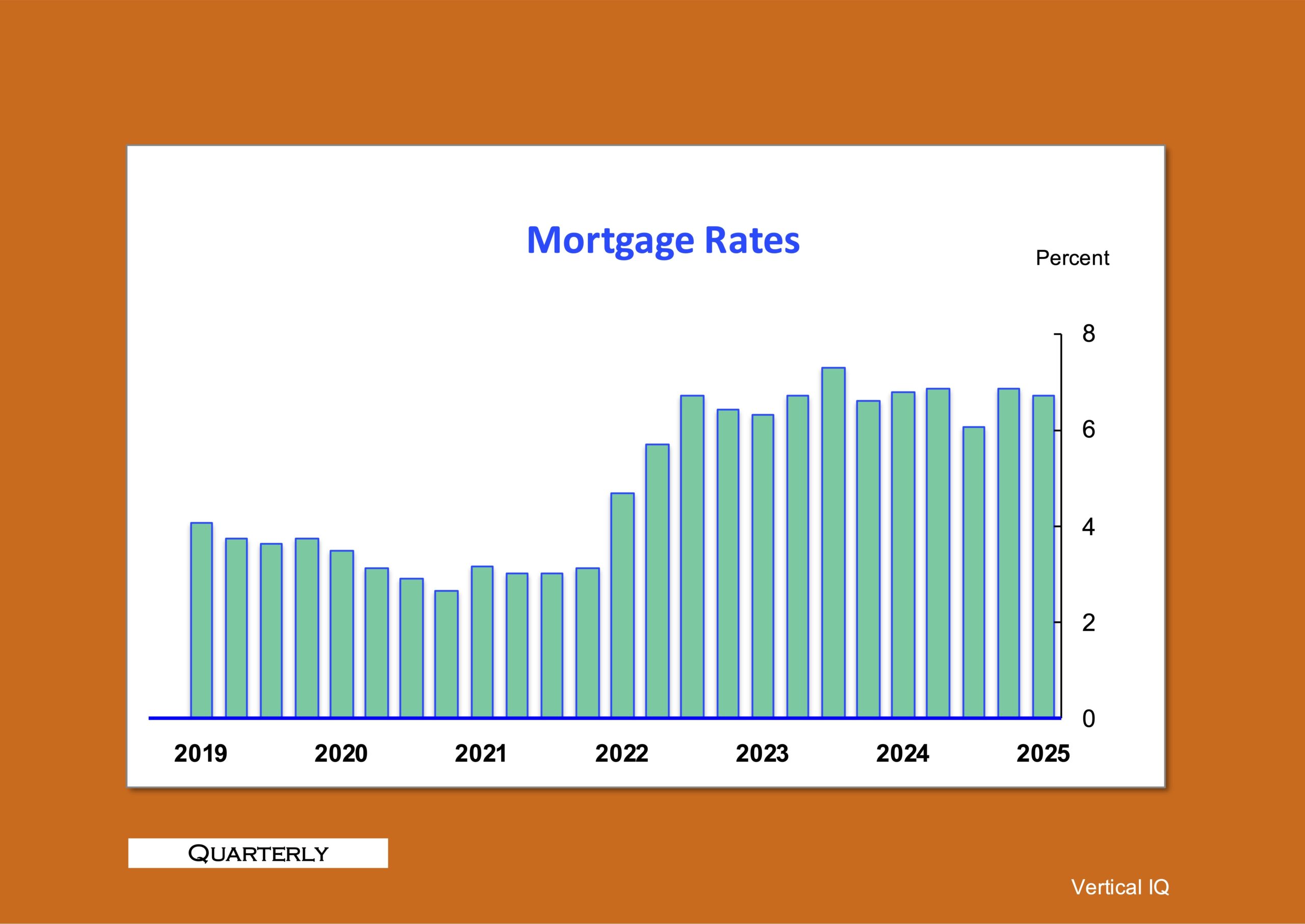

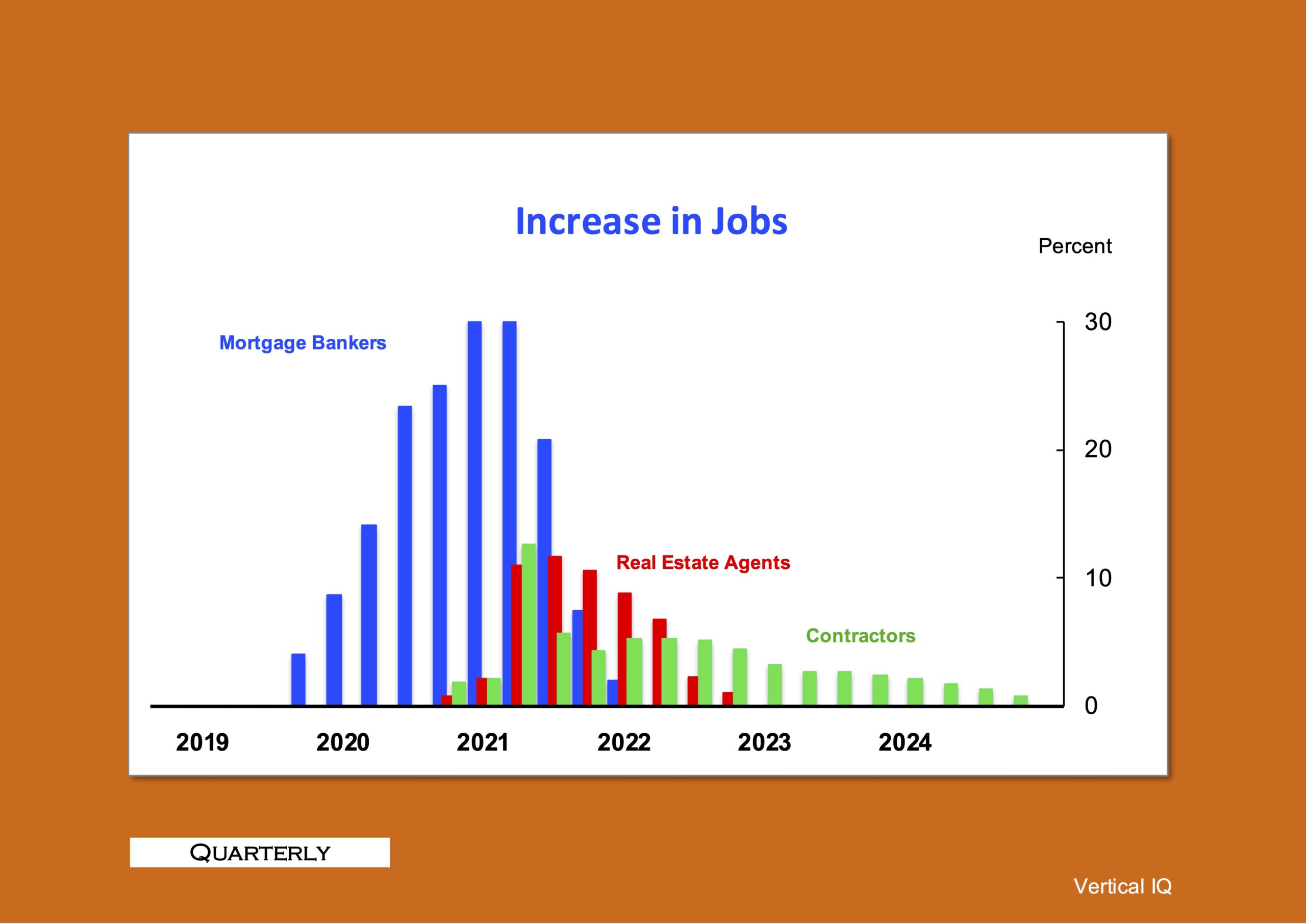

Interest rates are of special concern, especially to businesses connected with real estate. How changes in one area of an industry can trigger a sequence of changes in other areas is shown in these two charts (Figures 1 and 2).

The unexpected demand for homes during the Covid pandemic (as many people wanted to get out of town or just out of apartments) first produced new demand for mortgage bankers (who had shed jobs for the past two years) in 2020.

The initial volume of business was small, however, and jobs at real estate agencies and specialty contractors didn’t increase until 2021 as rising home prices provoked a surge in home-buying and home-building. Home prices rose almost 20% by the end of that year.

Then the Federal Reserve raised interest rates in 2022 in an attempt to quell inflation, and mortgage rates doubled. This affected mortgage bankers first, where jobs decreased in 2022. Jobs at real estate agencies went into the red in 2023, and demand for contractors petered out in 2024 as construction projects came to an end.

Regulations

The pharmaceutical industry is also a good example of the power of regulations, because on the one hand, drug companies benefit from patent monopolies, but on the other hand, they are dependent on the willingness of insurers — especially Medicare — to cover their drugs. As the U.S. population ages and more Americans are covered by Medicare, drug prices become more of a political issue.

Of course all companies have to deal with routine regulations concerning taxes and worker safety, but industries like chemical manufacturing, food production, and transportation have special requirements that can sharply affect their own profitability and that of their suppliers.

Local risks

Local businesses, like doctors, lawyers, and coffee shops, depend heavily on the strength of their local economy, changes in local incomes, and population growth.

For instance, over the last five years, the population grew 13% in Boise but shrank 4% in New Orleans, presenting different challenges for doctors, lawyers and coffee shops in those cities. A concentrated industry, like RV manufacturing in Elkhart, Indiana, or carpet manufacturing in Dalton, Georgia, or even just a big military installation or chemicals plant in a town, pose special problems for every other local business.

Preparing for the unknown

There are some forces, like a hike in interest rates or the cost of eggs, that businesses simply can’t predict. But they can prepare for them by identifying the risks they’re vulnerable to. More importantly, this preemptive identification allows them to operate more effectively in ordinary circumstances, where demand and supply are constantly fluctuating. Understanding the pressures a business faces is the first step to managing them successfully.

Learn how economic and Industry Intelligence can give you insider knowledge on businesses’ potential vulnerabilities — and ways to hedge against those risks. Request a Vertical IQ demo today!