NOT JUST FOR CREDIT ANALYSTS

Use Credit Underwriting & Risk data to structure deals and make lending decisions, as well as for business development, portfolio management, and more.

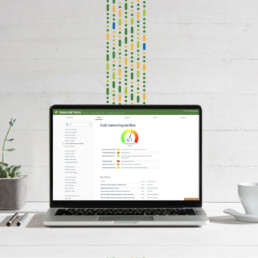

RISK RATING & METRICS

Our proprietary Industry Risk Rating shows the overall health of the industry, while the latest metrics and ratios guide your credit decisions.

CREDIT TOOLKIT

How does your client stack up? Compare them to industry competitors and peers with our interactive Financial Comparison Toolkit.

RISK CONSIDERATIONS

Learn about the top challenges impacting your client’s industry — issues that could hit their bottom line.

IN-DEPTH ANALYSIS BY CREDIT EXPERTS

Industry Risk Ratings & Key Metrics

Vertical IQ’s team of seasoned credit experts does the heavy-lifting for you with our proprietary Industry Risk Rating, plus Key Metrics data that can impact credit decisions. It’s like having an experienced commercial lender always at your side!

- Industry Risk Ratings are formulated using artificial intelligence and an advanced algorithm based on key “sub-category” ratings.

- The rating factors in financial risks, exit rates, industry performance during downturns, barriers to entry, and the industry’s outlook.

- Key performance metrics and financial ratios shine a light on the industry’s position within the overall economy.

CRUNCH THE NUMBERS

Financial Comparison Toolkit

Where does your client or prospect stand in relation to other businesses in their industry? Our Financial Comparison Toolkit, a custom analytics calculator, helps you weigh the real data.

- Input the numbers to compare your client’s key financial metrics to industry averages.

- Explore metrics like gross and operating profit margins, current ratios, and leverage.

- Add in your own comments or analysis and then download the industry research data with just a click.

KNOW THE ISSUES

Underwriting Considerations & Risks

Every vertical has its own unique set of challenges. Know the important issues you should consider to make an informed credit decision or offer sound financial guidance.

- Underwriting Considerations examines distinct aspects of the niche that may warrant additional scrutiny.

- Get a big-picture look at the latest challenges that are impacting the vertical by reviewing the Industry Risks.

- In Company Risks, explore the hurdles that specific businesses within the industry must confront.

THE VALUE OF CREDIT INSIGHTS

Credit expertise is useful for more than just making loans.

Save time when making credit decisions, yes, but also gain in-depth analysis and crucial credit risk information to provide the tailored financial advice your clients need to succeed.