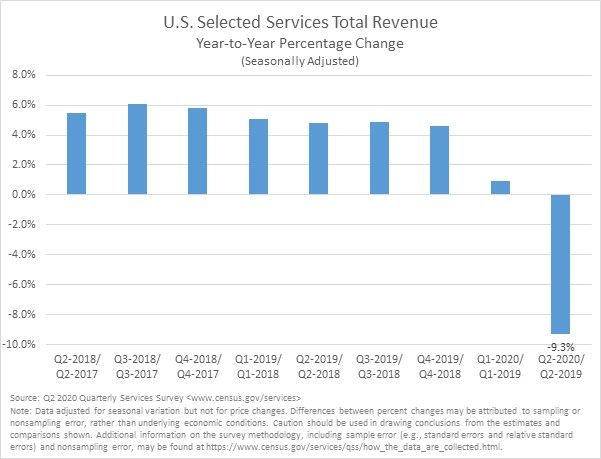

The U.S. Census Bureau recently released the selected services estimates for the second quarter of 2020. The survey revealed that total revenue for the second quarter of 2020 (seasonally adjusted, but not adjusted for price changes) was $3,650.4 billion. That’s down 9.1 percent as compared to first quarter of 2020 and down 9.3 percent versus the second quarter of 2019.

Let’s take a look at a few of the sectors that had the biggest dips in revenue between the first and second quarters of this year, as well as year over year.

Accommodations

With much business and leisure travel coming to a halt as a result of the pandemic, U.S. accommodations, that is to say, hotels/motels, RV parks, and campgrounds, have been hard-hit this year. Revenue in this vertical has plummeted, decreasing from $53 billion in the first quarter of 2020 to just $21.5 billion for the second quarter— a 59.4 percent drop. That Q2 figure is also down 69.7 percent from the same period in 2019, with hotels/motels bearing the worst of the losses — down 70.8 percent year over year.

Arts, entertainment, and recreation

Large gatherings have been put on hold in many states, so things like sporting events, theater performances, and concerts have come to a screeching halt. Museums and casinos have been closed or capacity restricted. As a result, the U.S. arts, entertainment, and recreation revenue for the second quarter of 2020 was $32.5 billion, a decrease of 51.2 percent from the first quarter of 2020 ($59.9 billion). It was also down 56.5 percent from the second quarter of 2019 ($75.7 billion).

Transportation and warehousing

Again, with travel being put on an indefinite hold for many people, airlines have suffered a huge decline in recent months, along with other forms of passenger and cargo transportation, and warehousing and storage facilities. Second quarter 2020 U.S. revenue for this sector was $173.5 billion, which represents a decrease of 28.2 percent from the first quarter of this year ($230.2 billion) and a 31.0 percent drop from the second quarter of 2019 ($256.1 billion).

Educational services

Educational services, which includes business schools as well as technical and trade schools, plus their support services (but excludes primary/secondary schools, colleges, and universities), suffered during second quarter too. During that period, U.S. educational services revenue was $13.6 billion, down 21.5 percent from the first quarter of 2020 ($17.3 billion) and down 27.7 percent from the same time last year ($18.8 billion).

Real estate and rental and leasing

While the new home construction industry has been booming in recent months, the real estate and rental/leasing sector isn’t doing as well. Second quarter 2020 real estate and rental and leasing revenue in the U.S. was $154.8 billion, a decrease of 18.4 percent from the first quarter of 2020 ($189.8 billion). It was also down 17.2 percent from the second quarter of 2019, when revenue was $186.9 billion. The biggest loser for this vertical was automotive rental and leasing, down 37.9 percent between the first and second quarters of the year. This stands to reason, again, with travel coming to a near standstill in many areas, meaning demand for rental cars tanked.

An end in sight?

These second quarter numbers are not particularly encouraging when it comes to the revenue of service industries in the U.S. this year. However, the Bureau of Economic Analysis estimates that overall gross domestic product (GDP) fell at an annual rate of 31.7 percent in the second quarter, so services have been doing better than the overall economy.

As more and more states lift stay-at-home orders and allow businesses to reopen, let’s hope we begin to see an upward shift in these trends in the next quarter. Though, with the convergence of cold and flu season with this pandemic, optimism may be in short supply in the coming months.

Photo credit: John Gucciono via Pexels