Harnessing the Power of Industry Intelligence and SBA Performance Data

In today’s competitive lending landscape, financial institutions are constantly seeking innovative ways to enhance their risk management, improve underwriting decisions, and ultimately drive growth. The partnership between Industry Intelligence experts Vertical IQ and Lumos Data, a leading provider of alternative data and insights for small business lending, will provide lenders with the actionable, convenient, focused tools needed to excel.

This partnership merges Vertical IQ’s industry-leading research with Lumos’ comprehensive SBA lending dataset, empowering financial institutions with a holistic view of industries and small businesses. By combining industry-specific data and actionable insights, lenders can make faster, more informed decisions throughout the SBA loan lifecycle.

The Value of Industry Intelligence

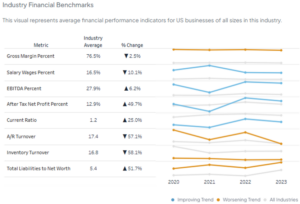

Lenders can identify potential industry-specific challenges or opportunities by understanding the nuances of a borrower’s niche. With so many verticals and so many unique factors to consider, access to Vertical IQ’s timely, digestible Industry Intelligence is essential for lenders to more accurately evaluate the financial health of borrowers in a wide array of industries. This data also allows lenders to quickly compare a borrower’s financial performance to peers and relevant industry benchmarks, leading to a more informed decision.

Industry: Hotels and Motels

The power of SBA performance data

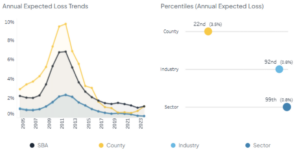

SBA performance data from Lumos provides lenders with invaluable insights into the creditworthiness of SBA borrowers across various industries, locations, and loan types. Lenders can keep an eye on the competitive lending landscape while identifying promising businesses that fit specific criteria. Especially when analyzing historical performance trends, lenders can detect patterns in defaults as compared to the SBA average default rate to identify an industry’s potential risks and opportunities.

Industry: Hotels and Motels

The Vertical IQ and Lumos Data advantage

The combination of Vertical IQ’s Industry Intelligence and Lumos Data’s SBA performance data creates a powerful synergy that benefits lenders in several ways:

- Reduce risk: With the unification of industry-specific insights and SBA performance data, lenders can gain a more comprehensive understanding of a borrower’s risk profile.

- Improve underwriting efficiency: Integrated access to both data sets allows lenders to make faster and more accurate underwriting decisions.

- Enhance the borrower experience: By leveraging alternative data, lenders can streamline the application process for borrowers, reducing the burden of paperwork and expediting loan approvals.

- Individual business performance: Utilizing alternative data sources complements traditional financial statements and offers a more nuanced view of a business’s health.

The partnership between Vertical IQ and Lumos Data represents a significant advancement for SBA lenders. By leveraging the power of Industry Intelligence and SBA performance data, your credit and risk management teams can make more informed lending decisions, reduce risk, and drive sustainable loan growth. As the SBA lending landscape continues to evolve, this type of streamlined data offers a valuable solution for financial institutions seeking to stay ahead of the curve and differentiate from their competitors.

To learn more about how Vertical IQ and Lumos Data can empower your lending decisions, visit Vertical IQ and Lumos Data.