Vertical IQ & Lumos Data Empowers Lenders with Insights

October 9, 2024

Harnessing the Power of Industry Intelligence and SBA Performance Data In…

Unlock Sales Readiness Highlight: Michelle Carpenter, Dart Bank

July 23, 2024

In our recent ebook, Unlock Sales Readiness: Advice from the Experts, Banking…

Unlock Sales Readiness Highlight: Kenneth Bostwick, Jr., Lakeland Bank

May 2, 2024

In our recent ebook, Unlock Sales Readiness: Advice from the Experts, Banking…

Vertical IQ Gives Bankers “The Right Stuff” to Save Time & Effort

April 30, 2024

A high-performing bank has bankers who understand both credit and industry-specific…

Unlock Sales Readiness Highlight: Carol Sexton, Cambridge Savings

April 23, 2024

In our recent ebook, Unlock Sales Readiness: Advice from the Experts, Banking…

Relationships Built on Trust and Expertise: A Conversation with Business Banking Thought Leader Leslie Parnell

March 5, 2024

Having served in various banking leadership roles for nearly 20 years, Leslie…

Industries Likely to Need Working Capital Financing in 2024

February 28, 2024

Vertical IQ and Lendovative Technologies are proud to offer the AR and Inventory…

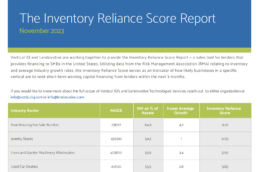

Identifying the Top Industries for Inventory and AR Financing in 2024

November 9, 2023

The SBA Office of Advocacy reports that 2.5 million new business formations…

Relational Accounting: Your Competitive Edge in a Data-Driven World

September 26, 2023

The following is a guest blog post by Amy Vetter, the CEO of B³ Method Institue,…

The Essential Calculation that Must Go into a Cash Flow Analysis

August 25, 2023

There are many topics about which a strong commercial or corporate analyst should…

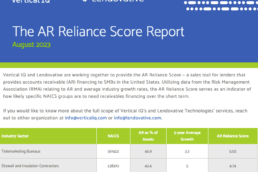

New AR Reliance Score Helps Predict Industries’ Short-Term Financing Needs

August 17, 2023

The following is a guest blog post by Pat True, the president of Lendovative…

Why I Created Local Market Monitor

June 8, 2023

Ingo Winzer is the founder of Local Market Monitor, a Vertical IQ product, which…

Attracting More Deposits: Ain’t You Special… Yet?

May 26, 2023

Vertical IQ co-founder and Clarity Advantage president Nick Miller has been…

First-Hand Account: How Readiness Wins in a Competitive Market

November 9, 2021

In this guest post, Jerry Bazata, a commercial lender in Portsmouth, New…

After PPP Ends, Don’t Overlook This Important Fourth “P”

May 6, 2021

By HD Jacobs, Senior Depository and Lending Solutions Product Specialist at S&P…

Potential Benefits and Downsides to Bank and Borrower

March 10, 2021

Guest post by David Nicholson, Owner of Credit Training Inc.

S&P Global Integrates Vertical IQ Industry Data to Help Lenders Better Understand Customers

January 25, 2021

By Guest Blogger Cam Saucier, Product Manager, U.S. Financial Institutions at…