There are approximately 105,000 HVAC/plumbing contractors across the United States, offering installation, repair, and maintenance services for air and water systems. They may focus on residential, commercial, institutional, or industrial sectors.

HVAC and plumbing services are highly reliant on the construction industry; this dependence means that trends that impact construction will likely influence HVAC and plumbing businesses too. Relatedly, the state of their local economy — whether it is growing or contracting — also serves as a barometer for HVAC and plumbing businesses.

For bankers and other financial services providers who currently work with contractors in this industry — or who are prospecting within it, it is valuable to understand how such undercurrents are influencing HVAC and plumbing businesses. Sharing these industry and local economic insights with business owners can be a tremendous value-add for them. Additionally, this knowledge can help you offer products and services that are tailored to HVAC and plumbing contractors’ unique needs.

Let’s take a closer look at the state of the HVAC and plumbing contractors industry, highlighting the latest trends, key challenges, and new opportunities that are influencing this vertical.

The broader construction economy

Construction has been one of the bright spots of the economy in the last few years, with jobs increasing at a 3% annual rate. Non-residential construction boomed with the construction of data centers and warehouses, while homebuilding benefitted from the sharp rise in home prices.

The current situation is less bullish, however. Overall, construction jobs continue to increase, though at a slower pace, but demand for trade contractors has peaked and is falling. With the prospect of a slower economy but continued high mortgage rates, contractors will face a more difficult environment in 2025.

How HVAC and plumbing contractors fit in

HVAC and plumbing contractors are still very much in demand, with the number of employees up 3% in recent months compared to 2024. That rate is slowing in both segments of the market; non-residential jobs are still up 3% but residential jobs are up just 2%.

Companies in the non-residential segment typically have 20 employees, those in the residential segment just seven. While there can be overlap in the type of projects they work on, the difference between commercial and residential HVAC and plumbing systems is large enough to prevent easy switching.

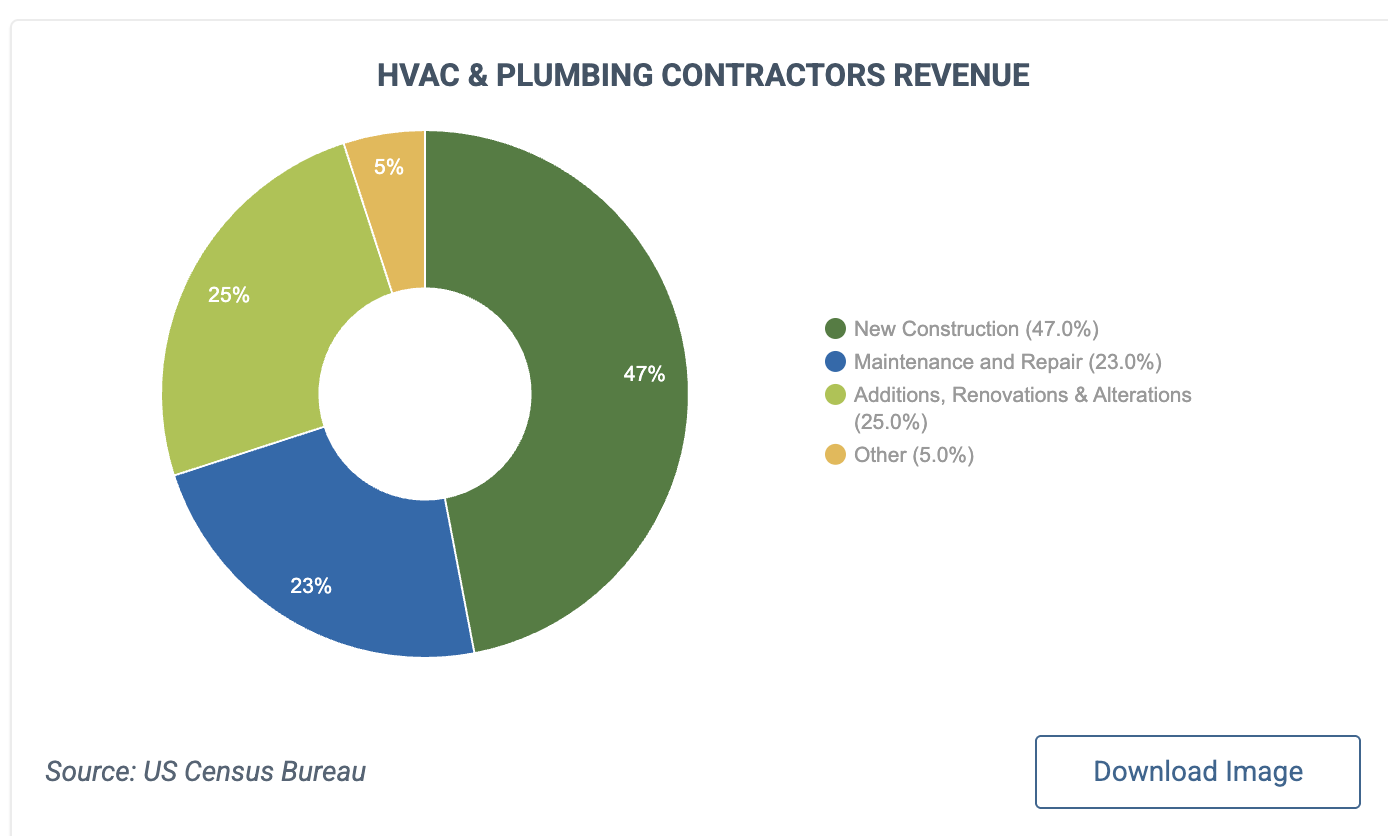

One major advantage for HVAC/plumbing contractors is that maintenance, repair, and retrofitting provide a steady flow of business even when the level of new construction (which can be more profitable) varies. But bear in mind that maintenance jobs typically make up only 23% of revenue while new construction projects generate 47% of revenue, on average. It’s important for bankers to understand how your HVAC customer’s revenue breaks down between the two. (See chart to the right.)

One major advantage for HVAC/plumbing contractors is that maintenance, repair, and retrofitting provide a steady flow of business even when the level of new construction (which can be more profitable) varies. But bear in mind that maintenance jobs typically make up only 23% of revenue while new construction projects generate 47% of revenue, on average. It’s important for bankers to understand how your HVAC customer’s revenue breaks down between the two. (See chart to the right.)

The overall ebb and flow of business, and the fact that business itself comes from individual projects, means that cash flow management is a major concern, as are payroll and payment systems. In addition, although project work typically involves progress payments, companies may have to fund the purchase of expensive HVAC and plumbing equipment until they’re reimbursed, as well as covering the costs of their own standard equipment like vehicles and hoists.

Keeping HVAC/plumbing contractors attuned to local markets

While analysts often focus on the nation’s economy, the picture at the local level can vary quite dramatically. Different local circumstances mean untapped opportunities for bankers who can recognize the nuances. This type of local insight also presents a unique way for bankers to lend value to their clients and prospects.

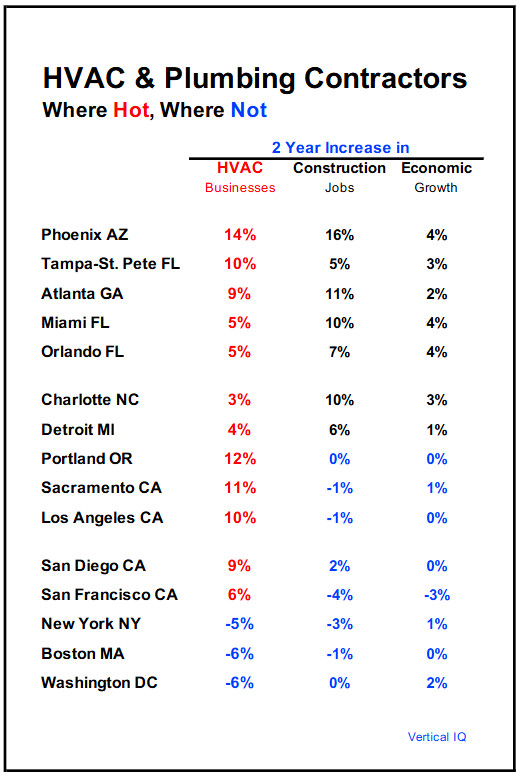

For instance, the amount of local construction activity, which is often linked to the overall growth of the local economy, is the main driver for HVAC and plumbing contractors. Bankers can closely monitor the level of construction growth or decline in their local area and keep clients informed of any shifts.

Bankers also can spot changes in the local industry environment that present new opportunities or challenges. For example, during business slowdowns, HVAC, plumbing, and other contractors often shrink their staff, some of whom may then start their own contracting businesses.

Bankers also can spot changes in the local industry environment that present new opportunities or challenges. For example, during business slowdowns, HVAC, plumbing, and other contractors often shrink their staff, some of whom may then start their own contracting businesses.

This can be seen in our table (right), which shows the increase or decrease in the number of local HVAC/plumbing contractors in 15 markets, along with two other measures of local economic activity.

For markets like Phoenix and Tampa, it’s clear that the overall local environment is very favorable. In this situation, bankers can focus on their ability to provide solutions for cash flow management and payment systems, as well as short-term inventory financing.

In New York and Boston, on the other hand, where the HVAC/plumbing contractor industry is shrinking, control systems and equipment liquidation may be more important areas for bankers’ attention.

And the increase in the number of HVAC businesses in Portland, Sacramento, and Los Angeles in the face of a difficult local economy means more start-ups of small contractors who often need a wide range of small business financial services.

>> Vertical IQ offers bankers the in-depth industry and economic insights they need to win, grow, and retain more business. View a free sample of the HVAC/Plumbing Industry Profile, and then sign up for a free 7-day trial of Vertical IQ!

Image: pexels-anilkarakaya