Restaurants are a trillion dollar industry in the United States. While chains like McDonalds and IHOP are found nationwide, single-location businesses make up most of the 700,000 restaurants across the country.

The average restaurant has a staff of 17 and annual revenue of just over $1 million. The low revenue per employee of $75,000 means that labor costs must be managed very carefully, while the low pay of $525 per week creates high employee turnover, requiring frequent hiring and training of new employees.

Changing tastes, rising prices: A recipe for challenges

Competition for restaurants comes from changing consumer habits, the proliferation of food-to-go outlets, and the rising cost of food compared to Americans’ average income, all of which impact revenue.

As one example of diners’ changing habits, many restaurants closed during the COVID-19 pandemic. Lockdowns deterred people from dining out, while layoffs forced many households to tighten their budgetary belts. As a result, the restaurant industry has only recently regained pre-pandemic employment levels.

Food prices also heavily impact restaurants’ bottom lines. Although the industry’s revenue is up 6% percent so far this year, much of that is due to higher menu prices as costs for cooking basics like eggs and beef rose sharply. Industry employment — a better measure of the number of diners served — is up just 1%. In the last four years, the cost of buying a meal at a restaurant is up a whopping 25%.

High costs, high ‘steaks’: Lenders should serve up cautiously

In addition to food price and quality, the location of a restaurant and its ambiance are also major factors in attracting customers (and encouraging them to return again and again).

Rent is often a large expense for a restaurant, since a better location usually means higher rent. Other costly investments can be kitchen equipment and dining room furnishings. (You’ll find insights into other potential equipment needs for the industry in the Capital Financing chapter of each full Vertical IQ Industry Profile.)

Bankers thus have several potential opportunities within the restaurant industry. There are almost always funding needs for the capital investment to start a restaurant. Bankers also can offer an array of business management solutions such as payroll, supplies ordering, payments to vendors, and cost control.

But balancing a restaurant’s high fixed costs against the variable and uncertain income from customers is a common challenge in the industry — one that creates a five-year failure rate of 50% for restaurants. For this reason, financial institutions may want to proceed with caution when offering financing to a new restaurant.

Feast or famine: The restaurant scene by city

On top of the factors discussed above, the growth of a restaurant business can depend heavily on rising local incomes, population growth, and tourism.

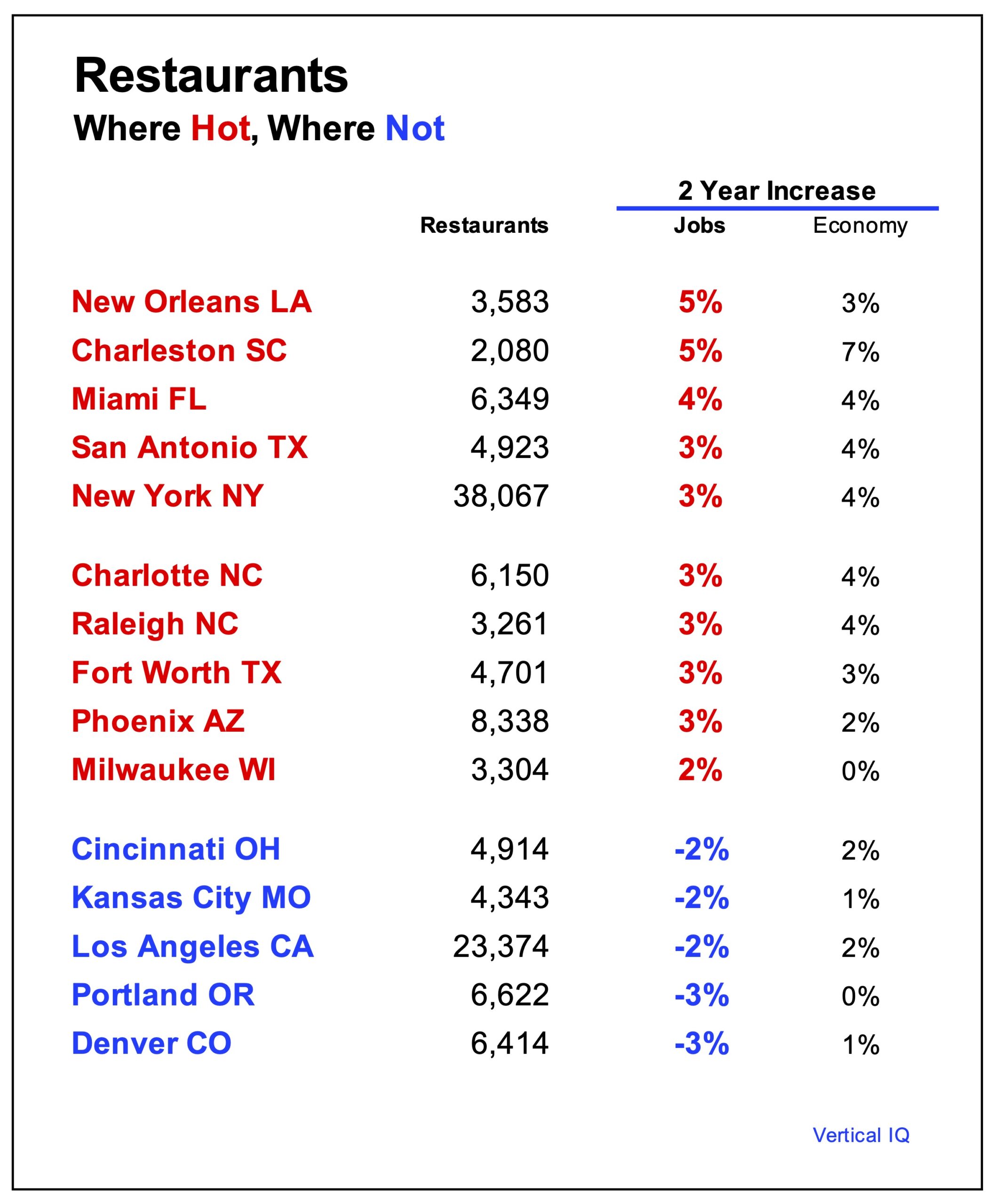

Pulled from Vertical IQ Local Economies data, our table (right) shows 10 local markets where the restaurant industry was thriving over the last two years, and five markets where it struggled, measured by the increase or decrease in restaurant jobs.

It’s not much of a surprise that New Orleans, Charleston, S.C., Miami, San Antonio, and New York City top the list; they all have a large tourism industry. It’s also no surprise that Cincinnati, Kansas City, Missouri, Los Angeles, Portland, Oregon, and Denver lost restaurant jobs; their local economies struggled on the whole during that time period.

Milwaukee is a bit of a surprise on the “Hot” list for the restaurant industry; it’s economy has been flat in recent years. The answer may lie in the fact that its number of restaurants increased 9% in the past two years, as can happen in a poor local economy when large restaurants are replaced by numerous smaller ones — each of which needs a staff.

Serving up banking solutions … carefully

Different local circumstances mean better/safer lending decisions for bankers who can recognize the differences. For instance, in local economies that are doing well, bankers can have confidence that careful lending to restaurants is good business. In poorly performing markets, however, financial institutions need to look more closely at the restaurant location’s fundamentals and demand.

The overall economic situation this year should also be taken into consideration when considering restaurant prospects. An economic slowdown will likely cut tourism, which in turn increases the risk for all restaurants in the U.S. heading into 2026.

>> Vertical IQ offers bankers the in-depth industry and economic insights they need to win, grow, and retain more business. Get a taste by viewing the Industry Overview, Industry Forecast & Structure, and Recent Developments chapters of the Restaurants Industry Profile, and then sign up for a free 7-day trial of Vertical IQ!

Main image: stefan-schauberger, unsplash