Dental practices and other privately-owned medical practices have long been attractive to banks for both financing and deposit products. Big picture, while dental practices need financing for initial capital expenditures and ongoing updates, and have operating costs that can reach 75 percent, they also have extremely low failure rates, and are usually located in “owner-occupied” offices. Dentist offices can generate gross margins of 90 percent while earnings before interest, tax, depreciation, and amortization (EBITDA) are typically around 15 percent. Additionally, specialized practices, such as periodontists and orthodontists, can reduce their overhead to around 60 percent while maintaining 90 percent gross margins.

Dental practices and other privately-owned medical practices have long been attractive to banks for both financing and deposit products. Big picture, while dental practices need financing for initial capital expenditures and ongoing updates, and have operating costs that can reach 75 percent, they also have extremely low failure rates, and are usually located in “owner-occupied” offices. Dentist offices can generate gross margins of 90 percent while earnings before interest, tax, depreciation, and amortization (EBITDA) are typically around 15 percent. Additionally, specialized practices, such as periodontists and orthodontists, can reduce their overhead to around 60 percent while maintaining 90 percent gross margins.

Drilling down into the industry’s potential

Because of their investment in years of education, dentists are unlikely to abandon ship, which provides a good credit risk for banks. Furthermore, with the expansion of dental insurance and the growing importance people place on their outward appearance, dentists’ demand is rising – confirmed by an 18 percent projected growth by 2024. With this trajectory, the ability to collect payments fairly quickly, and these other strong financial indicators, why wouldn’t a banker go after dentists?

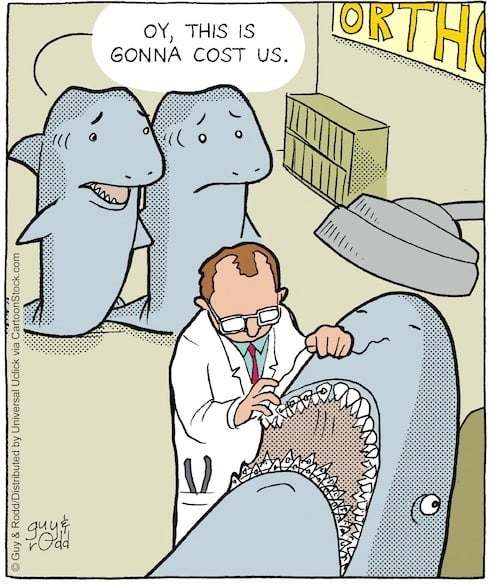

But therein lies the problem: Every banker wants to bank dentists – and they are all trying to push product after product down a dentist’s throat (pun intended) in order to win their business.

Filling the industry knowledge gap

So, think about it: When calling on a dentist, how much would you stand out from this gaggle of bankers if you showed that you actually understand the dental industry?! Instead of pushing some business credit card to them, what if you started your pitch by discussing ways you can help the dentist reduce their overhead costs from the typical 70 percent to a more profitable 60 percent? Not only would you instantly establish credibility with the dentist because you know what keeps them up at night, but you would position yourself to be the first person that dentist calls when he/she needs a loan for a new panoramic digital X-ray system (which can cost up to $75,000).

All this information and much more is easily accessible on the Dental Practices Industry Profile on Vertical IQ. Log in and find your own goldmine of an industry. It’s a simple formula: Become knowledgeable about their industry and you’ll become a trusted advisor to your business prospects and customers.

Talking points: Dentists’ main business challenges

- Demand for dental services had been thought to be “recession-proof,” but the Great Recession of 2007-2010 saw a drop in dental appointments and billings.

- Local competition for patients is intense in some geographical areas. Since it is relatively easy for patients to switch dentists, dentists in high concentration areas risk falling short of the 1,500 – 2,000 active patients typically needed for a profitable practice.

- Advances in preventative treatments can create new in-office revenue opportunities, such as regular oral cancer screenings. On the other hand, new sealants, rinses, and pharmaceuticals to prevent cavities and gum disease can lower demand for more profitable restorative procedures, such as implants, root canals, and crowns.

The dental industry has a high employee turnover rate with the average employee leaving in 2-3 years. Since dental hygienists and assistants are the primary contacts for most patients with a dental office, hiring and retaining skilled staff is critical.

Author: Drake Branson, Director of Business Analytics