As the nation’s 122,700 dental practices continue to advance in their technology and patient care techniques, the industry has seen significant changes in both the operational and clinical aspects of care delivery. Such shifts can yield a variety of banking and finance-related opportunities for the industry-savvy financial professional.

Providing general oral health services like preventative care and restorative treatments, dental practices normally have strong financials, including reliable payments and lots of valuable assets to borrow against, and they occasionally have complex financial needs.

But keep in mind: As with many small business owners, dentists are typically focused on their main area of expertise — practicing dentistry. As a result, their practices may be in need of targeted financial and business guidance.

To provide them with value-added advice that can benefit their business, you must first understand the industry-specific nuances of dental practices, essentials like:

- How their practice operates

- What types of local business issues they typically run into

- How they fit into the larger economy

Let’s explore the evolving landscape of the dental practice industry, examining emerging trends, challenges, and opportunities that are shaping the future of dental care.

Dental practices’ place within the broader healthcare sector

Healthcare has been the strongest sector of the U.S. economy during the last few years, creating new jobs at an average rate of 4% per year. This upswing is partly because some areas of the healthcare industry, like nursing homes, are still refilling positions lost during the Covid pandemic. But this increase in healthcare jobs is also attributable to consumers’ greater concern about their wellbeing. In fact, Americans now spend one of every six dollars on their health.

Similar to other healthcare niches, dental practices were also heavily affected by the pandemic, experiencing a 10% loss of jobs in 2020. But this dip was brief with the industry quickly recovering the following year.

Since then, jobs within dental practices have been added at close to 2% a year — akin to what they were before the pandemic, and well above the 1% growth rate of the population.

Examining the average dental practice

Most dental practices are small businesses, owned by dentists, with an average of just seven employees. They operate in a very competitive environment since it’s so easy for customers to switch to a new dentist. As a result of this (and because most people don’t like going to the dentist), customer relations and customer retention are very important considerations for dental practices.

Practices address these operational issues in several ways. On the one hand, they provide very labor-intensive preventative care like regular dental cleanings and screenings that help customers avoid more invasive procedures. But on the other hand, they also must invest in expensive equipment like computer-aided oral scanning and on-site production of crowns and other devices to make more complex procedures easier when they’re needed.

Local effects on dental practices

Dental practices are more or less alike just about everywhere, but local economic circumstances can create different challenges. It’s therefore important to consider the fact that dental practices operating in certain markets do have their own characteristics.

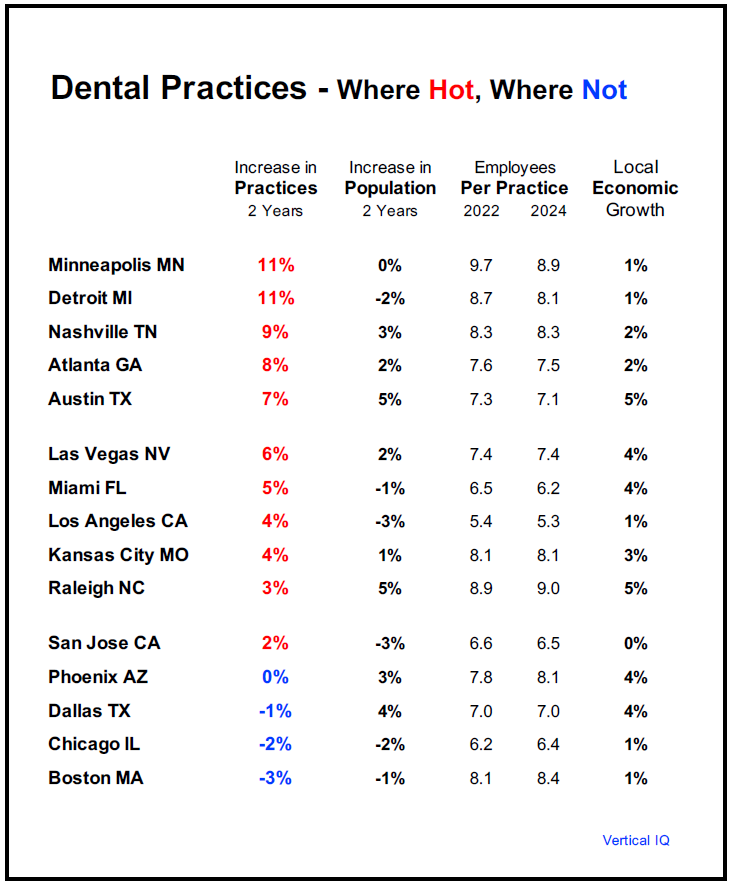

This Vertical IQ table (right) shows the increase or decrease in the number of dental practices over the last two years in 15 local markets, from an 11% gain in Minneapolis to a 3% loss in Boston. Some of these changes can be explained fairly simply; others can’t.

This Vertical IQ table (right) shows the increase or decrease in the number of dental practices over the last two years in 15 local markets, from an 11% gain in Minneapolis to a 3% loss in Boston. Some of these changes can be explained fairly simply; others can’t.

For instance, the growth of the local population and economy look like important drivers in Nashville, Atlanta, Austin, Las Vegas, Raleigh, San Jose, Chicago, and Boston. More of the same can be expected in 2025, so bankers would be wise to closely monitor these indicators.

In Minneapolis and Detroit, the decrease in practice size points to a surge of smaller practices, each of which need to invest in equipment.

Conversely, the absence of more practices in high-growth Phoenix is likely due to an increase in practice size. Larger practices may need more help with cash management.

And the solid growth of the economy in Miami seems to explain the increased number of practices, despite the city’s loss of population. This points to a wealthier demographic that welcomes higher-end services and investment in office and treatment equipment.

The biggest mystery in our table, however, is Dallas. These figures suggest that it’s totally out of step with the rest of Texas, where the number of dental practices increased 5% over this same period. It is possible there is a reporting lag impacting the data, but discussions with customers would give bankers a better understanding of the true on-the-ground situation there.

A clean check-up for dental practices

The dental practice industry in 2025 is navigating a period of growth, adaptation, and innovation. While the overall healthcare sector continues to thrive, dental practices face unique challenges and opportunities that require strategic attention. From local economic factors influencing practice dynamics to the adoption of advanced technology in patient care, the industry is evolving in response to both market demands and patient expectations.

As dental professionals continue to innovate and refine their services, staying informed about emerging trends and local market conditions will be essential for success. With the ongoing emphasis on oral health as a key component of overall wellness, the dental practice industry is well-positioned for a future of sustained growth and continued positive impact on public health.

>> Drill into Vertical IQ’s free Dental Practices Industry Profile to learn even more about how dental practices operate.

>> You can buy the comprehensive, 25+ page Industry Report on Dental Practices, or any of our hundreds of other industries, for just $400. Get even more value when you subscribe to the full Vertical IQ platform for as little as $450 per quarter with an annual subscription.