PAINT A COMPLETE FINANCIAL PICTURE

Comprehensive insights lead to better-structured, lower risk deals.

UNDERSTAND THE LANDSCAPE

Give your credit team in-depth insights on the prospect's industry, as well as their local economy.

ANALYZE LOAN RISK

Save time on research by using our credit toolkit, including key metrics and a proprietary Industry Risk Rating.

STRUCTURE SMARTER LOANS

Create tailored deals for your client that address unique credit needs within their industry.

CREDIT UNDERWRITING AND RISKS

Get a macro and micro look at the industry and economy.

Your credit team needs to understand not only the specific business’s financial picture, but also the overall state of their industry and local economy. Vertical IQ’s Industry Intelligence gives them the macro and micro level data to better inform lending decisions.

- The “Underwriting Considerations & Risks” chapter examines aspects of the industry that may warrant additional scrutiny, including relevant Industry Risks and Company Risks.

- The “Financial Benchmarks” chapter of each Industry Profile allows your credit team to compare a specific company’s performance to that of its industry peers.

- “Local Economies” enables credit underwriters to assess the health of a business’s local market, looking at what industries are growing or contracting, where jobs are being created or lost, and how unemployment rates compare to the overall economy.

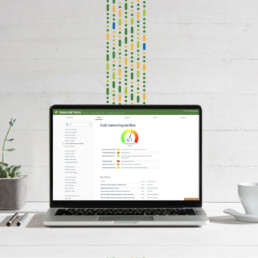

ANALYZE AN INDUSTRY'S POTENTIAL RISKS

Save time and be confident in your team's data points.

Time is money, but haste also makes waste! The Credit Underwriting & Risks chapter of each Vertical IQ Industry Profile was explicitly created with underwriters in mind. It contains extensive analytics and tools that will save time, lower risk concerns, and increase your confidence in lending decisions.

- We do the heavy-lifting with our proprietary Industry Risk Rating, formulated by seasoned credit experts, plus Key Metrics data on issues that can impact credit decisions.

- Input the numbers into our Financial Comparison Toolkit calculator to compare the client's key financial metrics to industry averages.

- Examine metrics like gross and operating profit margins, plus current ratios to get a more complete view of the client's industry.

IMPROVE LOAN STRUCTURE, WIN MORE BUSINESS

Develop credit packages tailored to the client's unique needs.

Give your credit team the industry expertise they need to not only meet your clients’ borrowing requirements but also exceed their expectations. Industry Intelligence from Vertical IQ gives bankers the in-depth analysis and risk information to provide the tailored financial solutions businesses need to succeed.

- With a thorough understanding of the client’s industry, pull together credit deals that solve unique challenges.

- Set your bankers apart from competitors and build client loyalty by passing along industry-focused content business owners can truly use.

- Identify cross-sell opportunities for card services, wealth management, treasury services, employee banking, and more with insights on industry-specific trends and bank product usage.

RMA's eMENTOR, POWERED BY INDUSTRY INTELLIGENCE

Arm your credit team with the tools they need to successfully win, grow, and retain more business.

eMentor, a collaborative solution created by our partner organization, the Risk Management Association (RMA), combines timely and actionable Vertical IQ Industry Intelligence with well-vetted credit risk management guidance, providing a single source of readiness information for credit and lending professionals.

eMentor not only educates bankers on clients’ pain points, it teaches them how to structure smarter deals and underwrite unique business loans.

BOOST CONFIDENCE, LOWER RISK

A resource your credit team can lean on.

Vertical IQ’s Industry Intelligence saves time for your credit officers and underwriters, but it also does something just as valuable: It increases lending confidence (for them AND you). When your team utilizes the credit tools and insights on Vertical IQ to learn about the risks, trends, and metrics within an industry, you can rest assured credit decisions – and your bank’s overall loan portfolio – are informed by objective data.