There are many topics about which a strong commercial or corporate analyst should have expertise. Ironically, that is one of the tough parts of the job as well as a great part of having a successful career in the world of commercial banking. Among the subjects a strong analyst needs to have expertise are financial statement analysis, how the financials connect to each other, financial accounting, leverage, liquidity, numerous industries, and on and on.

However, if I were to pick one topic about which an analyst needs to be an expert, it is how to calculate cash flow, as it is the primary source of repayment for the bank for all credit facilities (except a line of credit, which is the conversion of assets [AR and inventory]).

Importantly, cash flow is a calculation for many analytics in the world of finance, including the base calculation for enterprise value (the typical valuation used for a corporation) and a core covenant component for more risky leveraged financing opportunities. With most acquisitions, what companies actually are buying is cash flow. As such, analysts that are experts in calculating cash flow have significant value. Let’s examine cash flow calculations for the purpose of analyzing a bank’s primary form of repayment related to debt service coverage.

Calculating EBITDA vs. Cash Flow

The generic term for cash flow is earnings before interest, taxes, depreciation, and amortization, or EBITDA, but we should not be using EBITDA for cash flow calculations. There are many factors that impact the calculation of cash flow – more than we could cover in just one blog – but we will look at the appropriate ways to calculate it.

To fully understand cash flow and how to calculate it, one needs strong credit training.

Keep in mind, as I teach in my credit course, it is not enough to know how to do something. We should know why.

In short, EBITDA is inaccurate when calculating cash flow because it will lead to overstating or understating the primary source of repayment. To make the case for the flaws in EBITDA, I will use a simple example; but first, we must set a few important parameters that need to be understood and met when calculating cash flow.

- Cash flow for the purposes of paying debt service needs to be recurring. In understanding the recurring nature of cash flow, an analyst needs to understand where revenues come from and the likelihood of the revenues occurring in the future. The same with expenses.

- Cash flow needs to include revenue and expenses related to the core operations of the company. For example, a $900,000 check received by a company related to insurance proceeds from a fire is hopefully not related to the core operations of how the company generates revenues, thus it should not be included in cash flow. This item would be listed in “Other Income” under Operating Profit on the Income Statement.

- Adding back and subtracting non-cash events on the cash flow statement correctly is key. It is essential for credit training to cover non-cash events on the cash flow statement.

Example:

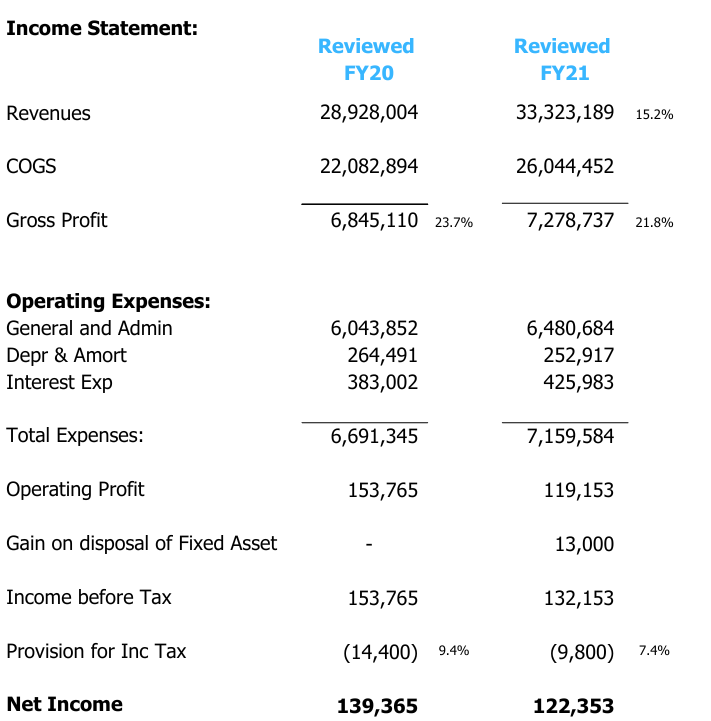

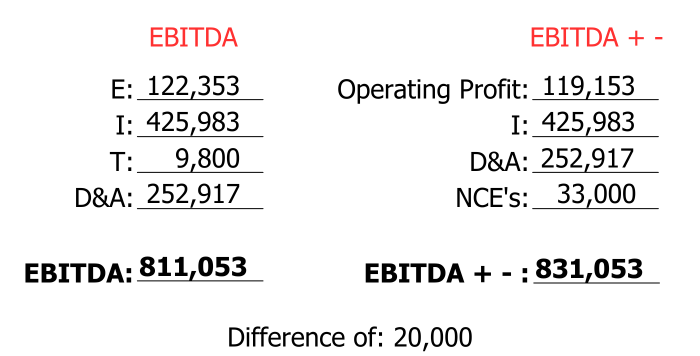

In this example, if we were to calculate FY21 cash flow based on EBITDA, we would be including the “Gain on disposal of Fixed Asset” of $13,000 as income. As stated previously, this income does not check the box of either parameter #1 or #2 above as it is not recurring and not related to the core operations of the company. If we were to calculate EBITDA based on the spelled-out acronym – earnings before interest, taxes, depreciation, and amortization – starting with net income of $122,353, we would add back taxes of $9,800, and then add back interest of $425,983 and depreciation of $252,917, totaling an EBITDA of $811,053. This EBITDA includes the $13,000 gain on disposal of fixed assets because the starting place of earnings included the $13,000 of income.

Calculating EBITDA vs. EBITDA + –

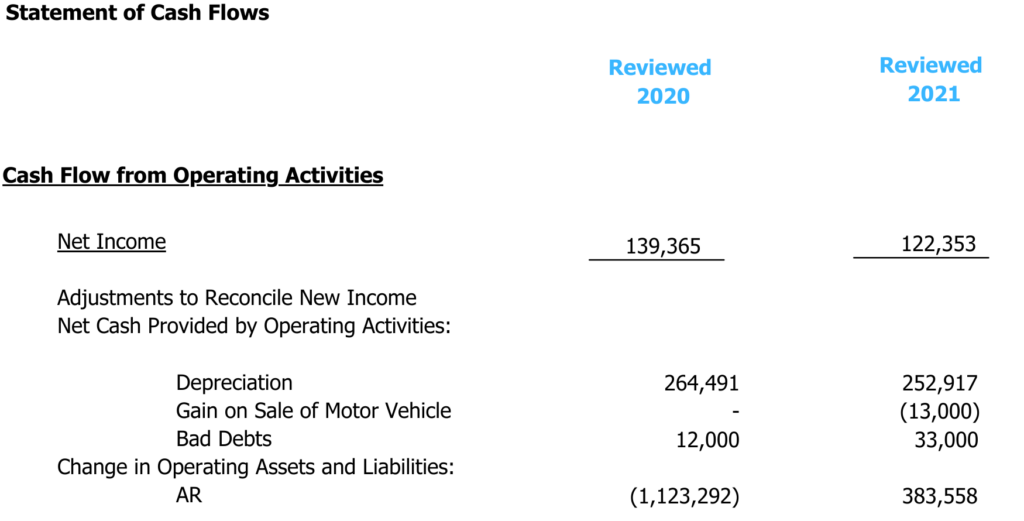

Calculating what I call EBITDA + – is a more efficient and more accurate way of calculating cash flow. Who doesn’t want to be more efficient and more accurate? I have pondered calling this concept “Operating Profit + -“ because I start at the operating profit line and add back or subtract any items that are above operating profit, including non-cash events from the cash flow statement. So, in the above example, I would start at operating profit of $119,153, then add back interest of $425,983, the non-cash events depreciation of $252,917, and bad debt expense of $33,000. The resulting cash flow figure is $831,053.

We can see the difference in calculating EBITDA and EBITDA + -:

It is important to note that a client may not be in violation of a covenant because the client followed the debt service coverage definition set by the bank. The point is that if the definition/calculation of cash flow set by the bank is incorrect, then both the bank and the client are at risk. This is a financial safety and soundness issue.

A more accurate cash flow calculation

In summary, calculating cash flow using EBITDA + – is:

- More efficient. When you start with operating profit, you already have added back or subtracted the items below operating profit.

- More accurate. By starting with net income, EBITDA does not require exclusion of non-recurring and non-operating income and expenses.

With these two points, analysts who are experts in calculating cash flow do not need the heavy oversight that untrained analysts do, which requires additional resources and leads to frustration in the commercial side of the bank.

In addition, EBITDA + – should be used in conjunction with changes in working capital on the cash flow statement, which points to free cash flow. Analyzing accrual-based cash flow (EBITDA + -) and UCA Cash Flow, including changes in working capital from the Balance Sheet, is important to see what has accrued along with what has actually happened. The Cash Flow Statement is net cash in and out of the company, and, specifically, we should look at changes in AR, Inventory, and AP.

It is for this reason that analysts need to be experts in calculating EBITDA + -, the bank’s primary form of repayment. Yes, the loans may be an asset on a bank’s balance sheet, but the risk of having analysts who are calculating cash flow incorrectly is a liability to the bank.

>> To learn more about the skills needed to master the art of credit analysis and write-ups, download our newest free ebook, A Credit Renaissance: Reduce Underwriting Lending Risk and Revive the Lost Art of Credit Analysis Using Industry Intelligence.

About David Nicholson, Founder, Credit Training, Inc.

David Nicholson had been in commercial banking for more than 20 years. Since 1997, David has analyzed and structured deals for hundreds of companies ranging from large corporate publicly traded companies to smaller middle market deals. David has been teaching credit for over 10 years and started teaching formal C&I credit training in 2015. Learn more at www.CreditTrainingInc.com.

Image credit: Vertical IQ